30+ Mortgage prepayment calculator

Please enter one of them Monthly payment or loan term. If you only have a couple more years to pay.

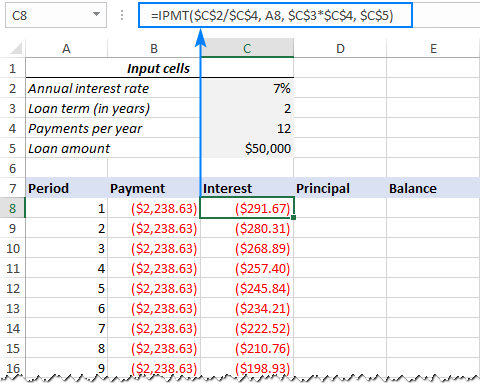

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Enter a principal amount an interest rate and the original loan term.

. Mortgage Calculator Excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. Mortgage payment The monthly mortgage payment is calculated based on the inputs you provided. Early Mortgage Payoff Calculator.

You may also enter 360 months for a 30-year loan or 15 years for a 15-year fixed or 180 months depending on loan type desired. When it comes to getting a mortgage in Ontario having a reliable mortgage calculator gives you some certainty ahead of time. Using our calculator above you can estimate the savings difference conveniently.

To use the early payoff mortgage calculator simply enter your original loan amount when you first received the loan along with the date you took out the home loan. While the 30. The calculator below also accounts for other homeownership costs such as real estate taxes homeowners insurance and HOA fees.

As of January 10 2021 the average mortgage rate for a 30-year FRM is 265 APR while the average interest rate for a 15-year FRM is 216 APR. This mortgage calculator uses the most popular mortgage terms in Canada. Use this calculator to determine your monthly mortgage payment and amortization schedule.

Making one additional monthly payment each year. Our calculator also includes mortgage default insurance CMHC insurance land transfer tax and property taxes. Refinance with a shorter-term mortgage.

You can find the mortgage interest deduction part on line 8 of the form. A mortgage calculator gives you valuable insight into what your regular payments and amortization sschedule will be in different scenarios eg different mortgage amounts different rates etc. Since mortgage interest is an itemized deduction youll use Schedule A Form 1040 which is an itemized tax form in addition to the standard 1040 form.

If you factor in other fees such as property tax insurance and PMI. Prepayment Amount Prepayment After Month Full Amortization Table. For the same 200000 30-year 5 interest loan extra monthly payments of 6 will pay off the loan four.

Please enter valid desire loan term between 1-30. Are commonly 30 years while Canadian amortization periods are usually 25 years. Then enter the loan term which defaults to 30 years.

A general affordability rule as outlined by the Canada Mortgage and Housing Corporation is that your monthly housing costs should not exceed 32 of. Mortgage Prepayment Calculator to calculate early payoff for your mortgage payments based on a desired monthly payment or the number of years until payoff. If you have a 30-year mortgage you can refinance to a 15-year mortgage with reduced interest.

Then enter either 1 how much you want to pay each month or 2 how long you want to make mortgage payments. The most common mortgage terms are 15 years and 30 years. This form also lists other deductions including medical and dental expenses taxes you paid and donations to charity.

Private mortgage insurance PMI you made a 20 down payment worth 65000. If you are a Scotiabank mortgage customer depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original principal. Buyer that allows the buyer to convert the ARM to a fixed-rate mortgage at specific times during the life of the mortgage.

The one-year two-year three-year four-year five-year and seven-year mortgage terms. For example a 30-year. Mortgages are how most people are able to own.

We count the number of days left from the date of your prepayment to the maturity date and we round it down to either 30 60 or 90 days the maximum is 90 days. There are a few ways to pay off a mortgage sooner than the 30-year term. In a 30-year fixed rate mortgage the interest payment that we make is probably very close to the mortgage itself.

This allows you to secure a lower rate and pay your mortgage earlier. Account for interest rates and break down payments in an easy to use amortization schedule. Options to pay off your mortgage faster include.

Bi-weekly payments instead of monthly payments. Our mortgage calculator contains BC current mortgage rates so you can determine your monthly payments. Of course mortgage regulations changes from province to province so its crucial that the mortgage calculator you use is specific to where you live.

Whats the prepayment charge for prepaying your mortgage. Using the calculator on this page you can work out your monthly payments total interest paid as well as the impact of taking out a different size. The mortgage amount rate type fixed or variable term amortization period and payment frequency.

For the exact prepayment charge and the costs associated with breaking your mortgage contract before the end of your. Where the prepayment charge is an interest rate differential the calculator tool estimated tool results will be in most cases be a higher amount than the actual prepayment charge. Our mortgage prepayment calculator can estimate the cost if you make prepayments or break your mortgage early.

Also if you have a specific interest rate in mind -- that you would like to prepay your mortgage as though it has a 2 interest rate for example -- youll want to also check out HSHs LowerRate SM Prepayment Calculator. Mortgage Prepayment Charge Calculator. BC Mortgage Calculator Location Please ensure your location is correct in order to find the best rates available in your area.

The mortgage calculator spreadsheet has a mortgage amortization schedule that is printable and exportable to excel and pdf. If your mortgage has costly prepayment penalty. If youve taken a 30-year FRM you can refinance to a 15-year term after a couple of years.

So if you can prepay your loan but cant refi you can PreFi your mortgage and get virtually the same savings. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. Use our free mortgage calculator to estimate your monthly mortgage payments.

Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI. The prepayment is assumed to happen before the first payment of the loan. Mortgage prepayment penalties are only allowed for the first three.

Savings Total amount of interest you will save by prepaying your mortgage. The following table compares costs between monthly mortgage. Mortgage terms in the US.

Recast your mortgage. How to use this mortgage prepayment calculator. This calculator will help you to determine the effective interest rate APR of your adjustable rate mortgage ARM when including the upfront closing costs in the ARM mortgage calculations.

Moreover it allows you to shift from a fixed-rate mortgage to an adjustable-rate mortgage ARM and vice versa. In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages. Saving 3420 in interest.

Pay extra each month. How to Pay Off a 30-Year Mortgage Faster. The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options including making one-time or periodic extra payments biweekly repayments or paying off the mortgage in full.

The Mortgage Payment Calculator allows you to calculate monthly payments average monthly interest total interest and total payment. Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff.

Tables To Calculate Loan Amortization Schedule Free Business Templates

Best 10 Mortgage Calculator Apps Last Updated September 6 2022

Printable Amortization Schedule Check More At Https Cleverhippo Org Printable Amortization Schedule

Best 10 Mortgage Calculator Apps Last Updated September 6 2022

![]()

Best 10 Mortgage Calculator Apps Last Updated September 6 2022

Refinance Mortgage Calculator Mls Mortgage Refinance Mortgage Home Refinance Free Mortgage Calculator

Best 10 Loan Calculator Apps Last Updated September 6 2022

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

What Are The Pros And Cons Of Pre Closing A Home Loan Quora

Best 10 Mortgage Calculator Apps Last Updated September 6 2022

What Are The Pros And Cons Of Pre Closing A Home Loan Quora

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Loan Emi Calculator In Excel Xls File Download Here

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora